Introduction

Qualcomm AI wearables complement smartphones — that’s the blunt takeaway from Qualcomm president Cristiano Amon’s recent comments at the company’s Snapdragon Summit and follow-up interviews.

Amon argued that phones will stay central but the user experience will shift: AI agents and new wearable hardware will extend, not replace, smartphones while enabling always-on, anticipatory services.

Why it matters

smartphone makers and chip suppliers must now design for a multi-device, AI-driven future. That affects chips, power budgets, app design, and how companies sell hardware to consumers and enterprises. Qualcomm’s roadmap — from Snapdragon AI chips to early 6G work — shows the firm betting on hybrid cloud/edge AI and new form factors.

Qualcomm AI wearables complement smartphones: Amon’s main point

Cristiano Amon said the smartphone “isn’t going away” but the center of the experience will move toward AI agents that live across phones, earbuds, glasses and other wearables.

He described a future where devices work together: the phone remains a hub for identity and heavy compute, while wearables provide immediate, context-aware actions (notifications, voice replies, glanceable UI). The message: expect more device diversity, not a single new dominant form.

What Qualcomm plans: chips, hybrid AI, and 6G

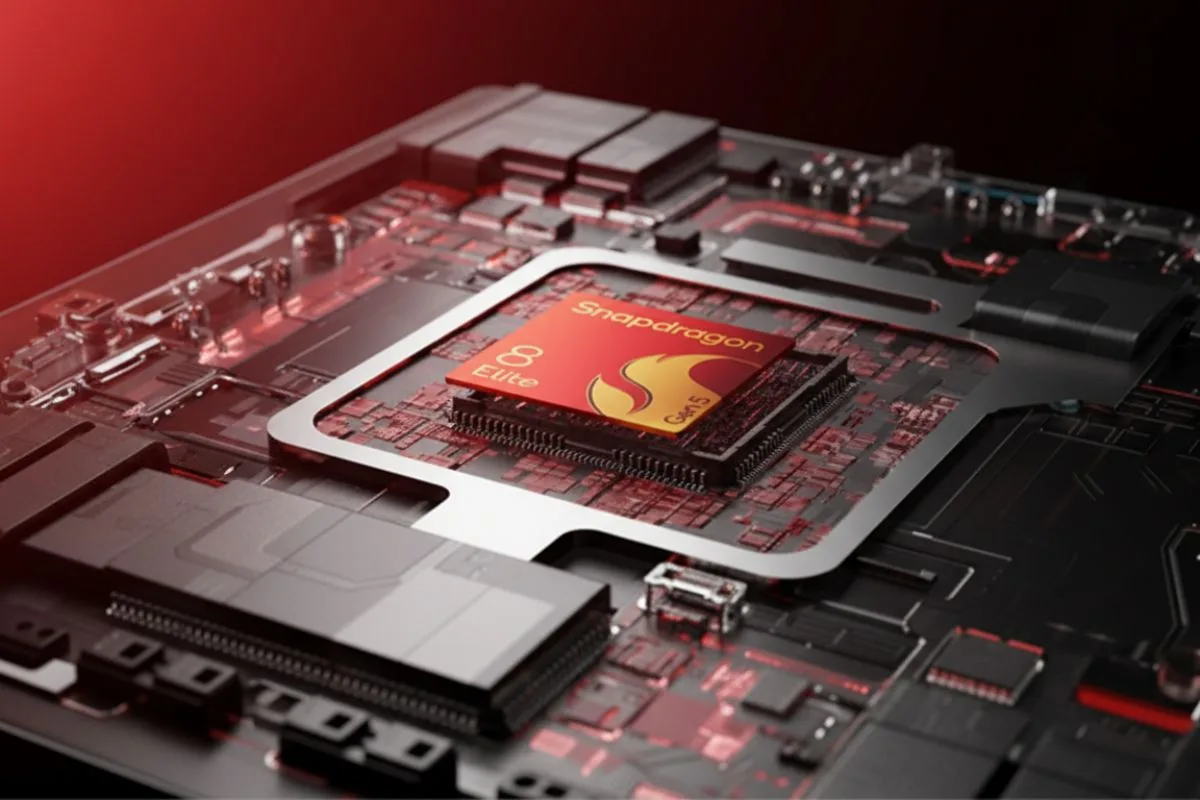

Qualcomm is pushing AI compute both on device and in nearby edge clouds. Amon highlighted new Snapdragon AI chips and a roadmap toward pre-commercial 6G devices by 2028 that can support persistent AI agents and sensor fusion.

The company argues that combining phone cores with efficient wearable compute will enable real-time personalization without sending all data to the cloud.

Why AI wearables will complement smartphones, not replace them

There are three practical limits that favor a complementary model:

- Power & thermal: wearables have strict battery limits; offloading heavy model work to phones or edge servers is efficient.

- User identity & continuity: phones hold SIM/credentials and large storage — important for payments, accounts and privacy controls.

- Interface diversity: wearables offer new input/output (voice, glance, haptics) that fits some tasks better than a phone screen.

Amon’s view aligns with industry analysts who see wearables as extensions that surface AI at the edge, not full replacements for rich interfaces and secure services.

What this means for consumers and app developers

For users, expect more seamless cross-device workflows: a brief voice summary on earbuds, a follow-up readout on your phone, and a persistent context in cloud memory.

For developers, that means designing multi-device state, managing privacy across endpoints, and optimizing models to run partly on wearables and partly on phones or edge servers. Qualcomm is promoting toolkits and SDKs to help partners split workloads efficiently.

Business and market implications

Chip vendors, phone makers, and accessory brands all benefit if the market fragments into multiple connected devices. Qualcomm’s strategy is to supply silicon across that stack — from phone SoCs to wearable AI cores — and to promote standards that let AI agents migrate between devices.

That positioning could lock OEMs and carriers into Qualcomm’s ecosystem if the performance and power wins materialize. Analysts expect early wins in earbuds and AR glasses before larger wearables scale.

Risks and what to watch

Key risks include battery life concerns, privacy and security (always-on AI raises new data governance questions), and fragmentation that confuses consumers. Regulators may focus on how AI agents use personal data across devices.

Watch for real product launches (earbuds, glasses) that show tangible AI benefits, not just demos, and for benchmarks comparing on-device inference versus cloud-assisted models.

Verdict

Qualcomm’s pitch is pragmatic: phones remain indispensable, but the user experience will be distributed.

AI wearables will complement smartphones by delivering fast, contextual interactions while relying on phones and edge systems for heavy lifting. The transition will reshape hardware design, app architecture and the competitive map over the next 2–5 years.

Frequently Asked Questions

Will Qualcomm AI wearables complement smartphones right away?

Qualcomm expects a gradual shift: earbuds and AR glasses will lead, with wearables offering AI features that work alongside phones. Broad consumer adoption will take several product generations.

What did Cristiano Amon exactly say about smartphones?

Amon said smartphones “aren’t going away” but predicted the user experience will shift to AI agents that span multiple devices, changing how people interact with tech daily.

Do wearables need phones to run AI features?

Often yes. Wearables will handle low-latency or local tasks, while phones or edge servers perform heavy model work, store identity, and manage privacy controls.

How soon will 6G and agent-style wearables arrive?

Qualcomm discussed pre-commercial 6G prototypes as early as 2028; practical, wide 6G rollouts and fully agent-centric wearables will take longer.

What should developers prepare for?

Build multi-device state syncing, design privacy-first agent flows, and optimize models for split execution across wearable, phone and cloud. Qualcomm plans SDKs to help with this shift.

Author note: I’m a tech reporter synthesizing Qualcomm’s Snapdragon Summit remarks and interviews. I used Amon’s direct comments and industry reporting to explain why wearables are likely to complement phones rather than replace them. I prioritized trusted sources and careful language where roadmaps and timelines remain tentative.