Introduction

The U.S. government is weighing a bold “1:1” chip production rule that would ask semiconductor makers to produce domestically as many chips as their customers import — or face tariffs.

The idea, reported by the Wall Street Journal and summarized by Reuters, is meant to accelerate on-shore manufacturing and strengthen supply chains for critical technology and defense systems. Officials say incentives would likely accompany any requirement, but exact timelines, counting rules and exemptions are still being discussed.

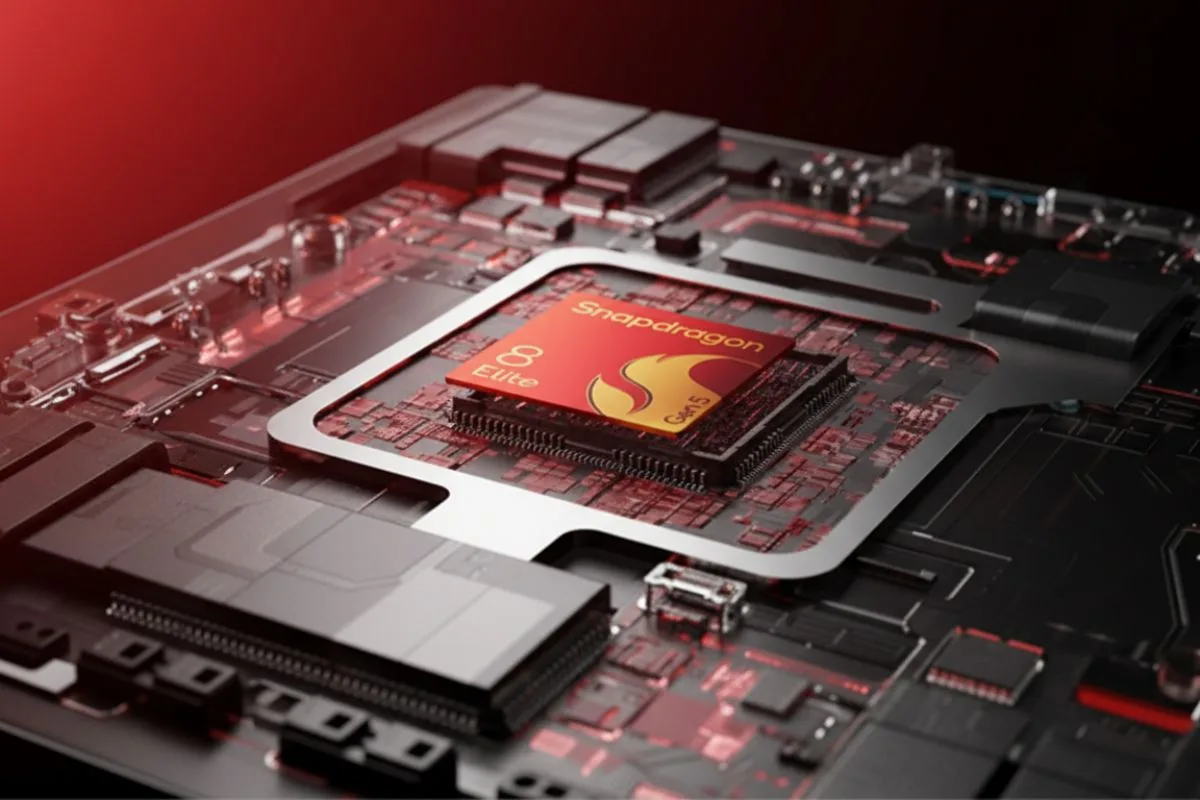

Why this matters: advanced chips run phones, cloud servers and AI systems. Policymakers say the rule would speed investment and reduce dependence on a few foreign fabs; industry groups warn it could raise costs and complicate global supply chains.

U.S. plans 1:1 chip production rule to curb overseas reliance

People familiar with deliberations say Commerce Department staff and White House advisers are exploring a mandate to match imported chip volumes with verified U.S. output. Firms that miss a phased target could face tariffs on imported chips or finished products containing those chips.

Officials are discussing a mix of phased targets, credits for pledged U.S. capacity, and transition windows so companies can build plants without immediate penalties. No formal rule has been published yet.

How the 1:1 chip production rule would work in practice

Early design ideas include: setting a baseline import period, defining a clear counting method for chip types, offering credits for verified domestic investments, and pairing the rule with CHIPS Act funding and grants.

The CHIPS and Science Act has already directed roughly $52.7 billion toward U.S. chip manufacturing and research — funds policy-makers would likely use alongside any new mandates.

Counting chips and technical hurdles

Chips vary widely — memory, logic, analog and AI accelerators differ in complexity and value. Industry groups stress that any counting rule needs precise definitions to avoid loopholes and unfair burdens.

Experts also note advanced fabs cost billions and can take three to five years to build, so timelines and credible credits are essential for fairness.

Industry reaction and market impact

Foundries already expanding U.S. capacity — such as the large multi-billion commitments from top global firms — could benefit from stronger domestic demand. But device makers that rely on global suppliers may face higher parts costs if tariffs are applied.

Reports also warned that new tariff policies could hit equipment makers and suppliers, and might add costs that flow to consumers if not mitigated.

International and diplomatic implications

Trading partners that host major fabs — Taiwan, South Korea, Japan and the EU — are likely to press for exemptions, phased timelines or waiver mechanisms.

Observers expect intense diplomatic talks to prevent a fracturing of the global semiconductor ecosystem and to preserve cross-border investment. Rule design will need to balance security goals with existing trade relationships.

Economic trade-offs: jobs, costs and long-term gains

Supporters say reshoring chips could create thousands of high-paying jobs and spur tens of billions in new investment. Building and equipping a modern fab can cost $10–$20 billion and take several years, so matching policy ambitions with financing and workforce development is critical.

Critics caution that tariffs or blunt measures could raise electronics prices and invite legal and trade pushback.

What companies should do now

Executives should model supply-chain scenarios, accelerate credible U.S. capacity plans and engage with regulators during the rulemaking process. Firms may qualify for credits by pledging verified U.S. investment or pursue temporary waivers while fabs ramp production.

Observers say a mix of incentives and carefully targeted penalties will most likely be needed to achieve the policy’s aims without major market shocks.

Conclusion

A one-for-one production rule would be a forceful industrial policy to secure chips for industry and defense. Its success will hinge on precise technical rules, realistic timelines, and large public incentives to finance costly new factories. Watch for formal rulemaking and the public comment period in coming months.

Frequently Asked Questions

What is the 1:1 chip production rule?

The 1:1 rule would ask chipmakers to produce domestically as many chips as their customers currently import, or face tariffs. The idea is to rebuild U.S. chip capacity and reduce reliance on foreign fabs.

Will companies immediately face tariffs?

Not necessarily. Reports say officials are considering phased targets, credits for pledged U.S. capacity and transition periods before tariffs would apply. No formal rule is public yet.

How long does it take to build a new chip fab?

Advanced fabs typically cost $10–$20 billion to build and can take three to five years to become fully operational. Policy timelines must account for that reality.

Could the rule increase prices for consumers?

Economists warn tariffs or reshoring costs could raise device prices if added costs are passed on. Officials plan to pair rules with incentives to limit consumer impact

When will the rule be final?

The measure is still under discussion. Formal rulemaking, including a public comment period, would normally follow before any enforcement.

Author note: I’m a tech policy reporter. This article was compiled from reporting by the Wall Street Journal, Reuters and industry reports. The 1:1 rule is still under discussion; I used careful language (“reported”, “people familiar”) where proposals are not yet final. I’ll update the story when the Commerce Department or White House issues formal text.